Real Estate vs Inflation

Inflation reduces the purchasing power of money over time, making it essential for investors to find ways to preserve wealth. Real estate has consistently proven to be one of the best hedges against inflation, with property values and rental rates increasing alongside the cost of living. In the modern era, tokenization makes it easier to access these inflation-resistant assets and diversify across multiple properties.

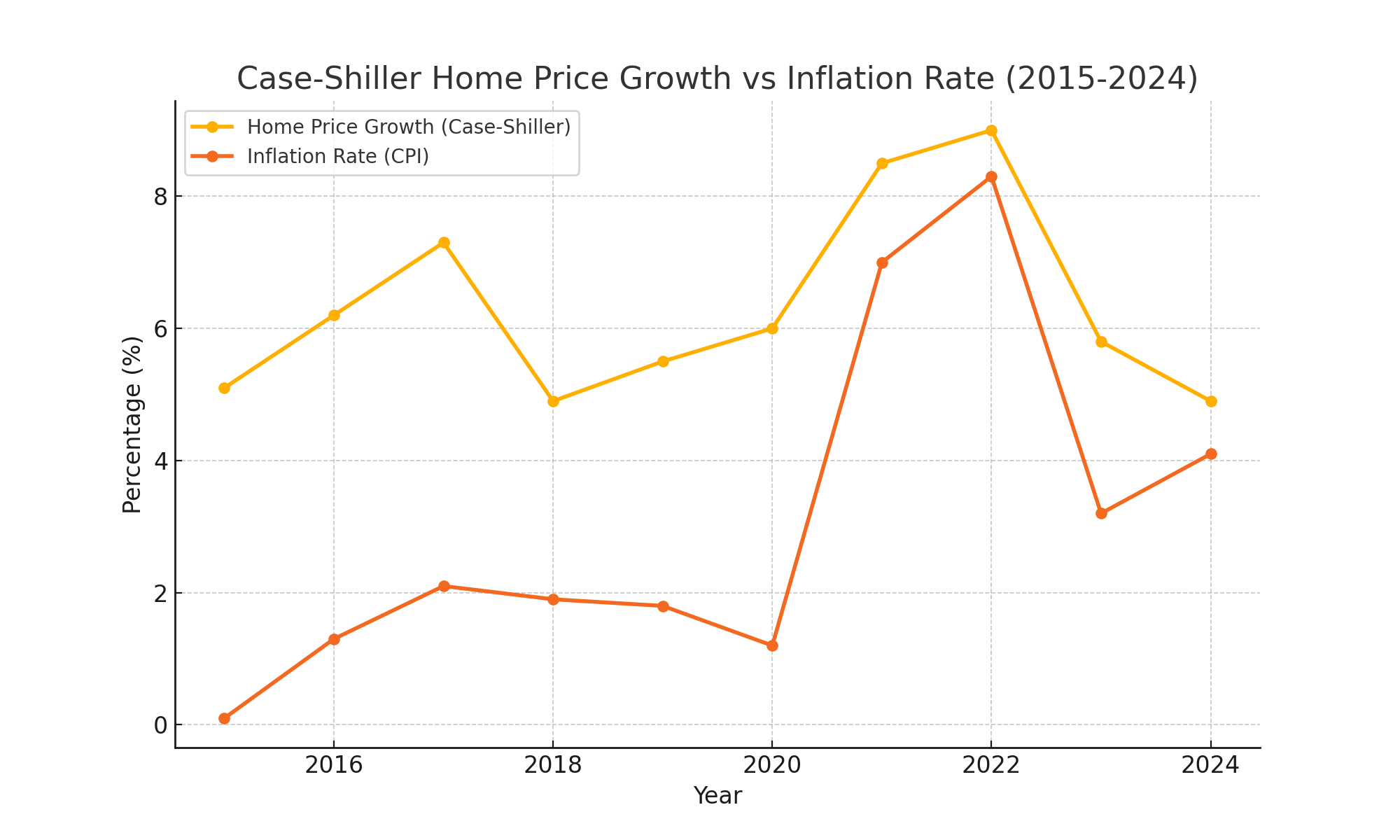

Figure: Case-Shiller Home Price Growth vs Inflation Rate (2015-2024)

Source:

S&P CoreLogic Case-Shiller Home Price Index – https://ycharts.com/indicators/case_shiller_home_price_index_national

Consumer Price Index (CPI) – https://fred.stlouisfed.org/series/CPIAUCSL

Real Estate: A Reliable Hedge Against Rising Prices

When inflation increases, so do property values and rental income. Real estate protects investors from losing purchasing power, offering returns that keep pace with inflation. Unlike stocks or fixed-income investments, real estate delivers reliable income and growth, even in volatile markets.

Tokenization Insight: Tokenized real estate provides fractional ownership in inflation-protected assets. Investors can own parts of multiple properties rather than committing all their capital to one, spreading risk and benefiting from increasing property values and rental income. Tokenization also brings liquidity to an otherwise illiquid market, enabling investors to buy, sell, or trade their assets more easily.

Leverage and Inflation: A Winning Combination for Investors

Leverage, when combined with inflation, significantly enhances the profitability of real estate investments. With a fixed-rate mortgage, investors lock in predictable debt payments, while inflation erodes the real value of that debt over time. Essentially, loans are paid back with dollars that are worth less, increasing the investor’s overall return on investment (ROI).

For example, in an inflationary economy, a property bought with a mortgage in 2020 is likely to generate much higher rents by 2025. Yet, the investor’s mortgage payment remains the same, driving significant cash flow and equity growth.

Tokenization Insight: Through tokenization, investors can gain exposure to leveraged real estate projects. This allows smaller investors to benefit from appreciation and rising cash flow without taking on direct debt. Tokens representing partial ownership of leveraged properties give access to the same inflation-driven advantages enjoyed by large-scale property owners.

Conclusion: Secure Your Wealth with Tokenized Real Estate

Inflation is an unavoidable economic reality, but real estate provides a powerful tool to safeguard wealth and ensure long-term returns. Tokenization democratizes access to this asset class, enabling investors to diversify portfolios with fractional property ownership. These tokenized assets offer flexibility, liquidity, and inflation-protected income, helping investors build resilient portfolios in any economic climate.

Real estate isn’t just an inflation hedge—it’s an opportunity to grow wealth while mitigating the risks inflation brings. With tokenization transforming the market, now is the time to explore how digital ownership can amplify the benefits of real estate investment.